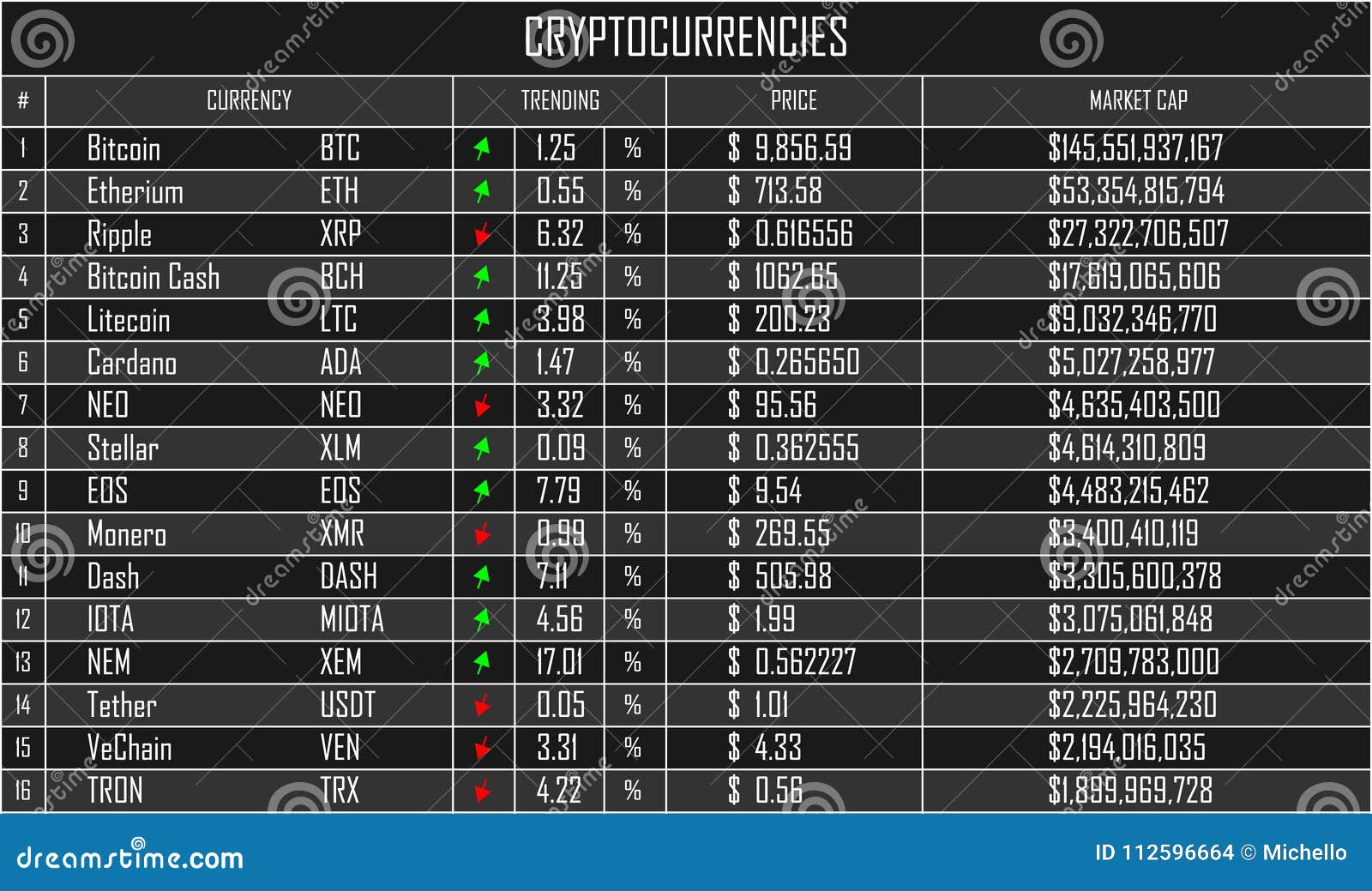

Market cap of all cryptocurrencies

Related Links Are you ready to learn more? Visit our glossary and crypto learning center. Are you interested in the scope of crypto assets? Investigate our list of cryptocurrency categories 10 deposit bonus. Are you interested in knowing which the hottest dex pairs are currently?

The first chain to launch smart contracts was Ethereum. A smart contract enables multiple scripts to engage with each other using clearly defined rules, to execute on tasks which can become a coded form of a contract. They have revolutionized the digital asset space because they have enabled decentralized exchanges, decentralized finance, ICOs, IDOs and much more. A huge proportion of the value created and stored in cryptocurrency is enabled by smart contracts.

One of the biggest winners is Axie Infinity — a Pokémon-inspired game where players collect Axies (NFTs of digital pets), breed and battle them against other players to earn Smooth Love Potion (SLP) — the in-game reward token. This game was extremely popular in developing countries like The Philippines, due to the level of income they could earn. Players in the Philippines can check the price of SLP to PHP today directly on CoinMarketCap.

Cryptocurrency market capitalization (market cap) refers to the total value of a particular cryptocurrency that is currently in circulation. It is calculated by multiplying the current market price of a cryptocurrency by the total number of coins or tokens that have been issued. The total market capitalization of all cryptocurrencies for today is $3,482,102,116,442

CoinMarketCap does not offer financial or investment advice about which cryptocurrency, token or asset does or does not make a good investment, nor do we offer advice about the timing of purchases or sales. We are strictly a data company. Please remember that the prices, yields and values of financial assets change. This means that any capital you may invest is at risk. We recommend seeking the advice of a professional investment advisor for guidance related to your personal circumstances.

Are all cryptocurrencies based on blockchain

The nature of blockchain’s immutability means that fraudulent voting would become far more difficult. For example, a voting system could work such that each country’s citizens would be issued a single cryptocurrency or token.

How are Bitcoin Mining Pools different from Cloud Mining? Bitcoin Mining Pools are a way for miners to get together and form a bigger group to mine bitcoins. This allows them to receive more payouts because their bitcoins will be spread out across the entire group instead of going towards just one miner. Cloud mining is another way for miners to get together and mine with others, but it’s not as widely accepted or used as bitcoin mining pools because of the added risk that comes with purchasing shares in an unclear company or pool.

The nature of blockchain’s immutability means that fraudulent voting would become far more difficult. For example, a voting system could work such that each country’s citizens would be issued a single cryptocurrency or token.

How are Bitcoin Mining Pools different from Cloud Mining? Bitcoin Mining Pools are a way for miners to get together and form a bigger group to mine bitcoins. This allows them to receive more payouts because their bitcoins will be spread out across the entire group instead of going towards just one miner. Cloud mining is another way for miners to get together and mine with others, but it’s not as widely accepted or used as bitcoin mining pools because of the added risk that comes with purchasing shares in an unclear company or pool.

The decentralized nature of the blockchain network ensures that no single entity controls the system, allowing for a secure and transparent system that supports the cryptocurrency network. Blockchain provides the infrastructure that supports the cryptocurrency network, ensuring the integrity and accuracy of all transactions.

Transactions on the blockchain network are approved by thousands of computers and devices. This removes almost all people from the verification process, resulting in less human error and an accurate record of information. Even if a computer on the network were to make a computational mistake, the error would only be made to one copy of the blockchain and not be accepted by the rest of the network.

All cryptocurrencies

Price volatility has long been one of the features of the cryptocurrency market. When asset prices move quickly in either direction and the market itself is relatively thin, it can sometimes be difficult to conduct transactions as might be needed. To overcome this problem, a new type of cryptocurrency tied in value to existing currencies — ranging from the U.S. dollar, other fiats or even other cryptocurrencies — arose. These new cryptocurrency are known as stablecoins, and they can be used for a multitude of purposes due to their stability.

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

Welcome to CoinMarketCap.com! This site was founded in May 2013 by Brandon Chez to provide up-to-date cryptocurrency prices, charts and data about the emerging cryptocurrency markets. Since then, the world of blockchain and cryptocurrency has grown exponentially and we are very proud to have grown with it. We take our data very seriously and we do not change our data to fit any narrative: we stand for accurately, timely and unbiased information.

Price volatility has long been one of the features of the cryptocurrency market. When asset prices move quickly in either direction and the market itself is relatively thin, it can sometimes be difficult to conduct transactions as might be needed. To overcome this problem, a new type of cryptocurrency tied in value to existing currencies — ranging from the U.S. dollar, other fiats or even other cryptocurrencies — arose. These new cryptocurrency are known as stablecoins, and they can be used for a multitude of purposes due to their stability.

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

Welcome to CoinMarketCap.com! This site was founded in May 2013 by Brandon Chez to provide up-to-date cryptocurrency prices, charts and data about the emerging cryptocurrency markets. Since then, the world of blockchain and cryptocurrency has grown exponentially and we are very proud to have grown with it. We take our data very seriously and we do not change our data to fit any narrative: we stand for accurately, timely and unbiased information.