Posts

- Best High-Yield Discounts Profile out of Can get 2025

- Negotiable Purchase out of Withdrawal (NOW) Membership

- A discussion: Should the All of us improve the $250,100 ceiling to your put insurance?

- Just what it methods to have FDIC insurance rates

- Life Property Beneficiaries

- Tips Know if Your bank account is covered

When you have numerous account at the same standard bank, you might communicate with an excellent banker regarding the those are safe up to the brand new FDIC limit as well as how far you may have in excess places. You could make use of the FDIC’s Digital Put Insurance Estimator to help you assess their insurance coverage based to your control group and you may balance. Legislation provides that accountability of your United states to have settlement is generally discharged by a payment equal to the present worth of all coming payments of compensation computed during the a four per cent correct dismiss rates combined a year. In your case this would be $0000.00, since Day.

Best High-Yield Discounts Profile out of Can get 2025

Consider some examples understand the fresh constraints of FDIC coverages. $250,one hundred thousand per book beneficiary permitted the newest account. 4.66%The fresh Axos One to Bank account tend to earn a promotional rates out of around 4.66% APY to the report cycle the spot where the conditions is actually came across. Tony Armstrong prospects the new banking team at the NerdWallet.

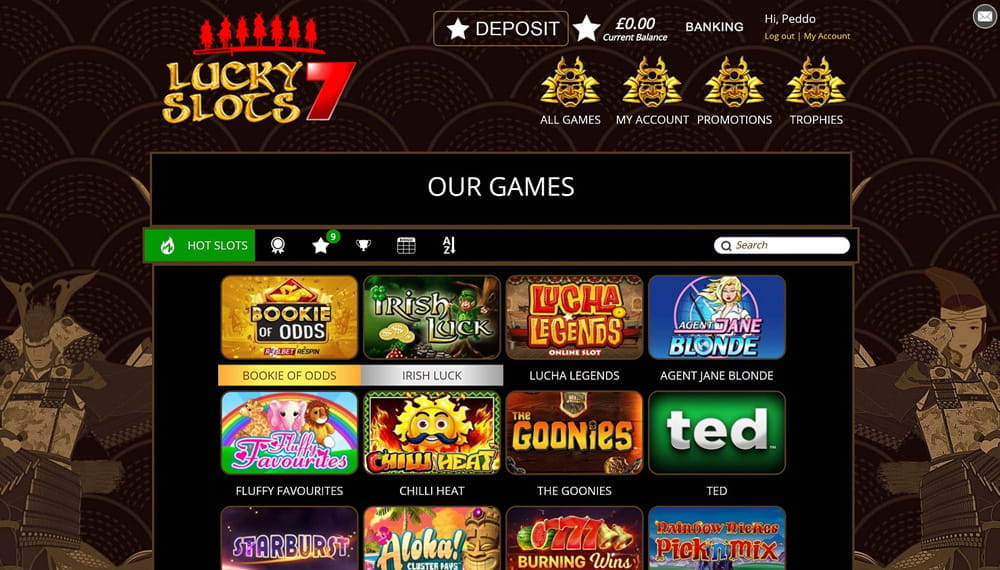

The fresh Go back to User (RTP) payment in the Slingo video game means how much cash is returned to help you professionals out of the complete wagers to the new confirmed game. Technically, it means £95 of any £a hundred wagered are gone back to people. You can gamble Slingo with at least bet from £0.1, but you in addition to play with large wagers. All of these Slingo Video game is a little while such as for every other, however, just have a fellow motif.

Negotiable Purchase out of Withdrawal (NOW) Membership

The brand new Minute does not apply to Job Corps otherwise overseas federal says. When creating repayments for these times, the new Ce is always to go into a job code in case government system to stop overpayments. The newest Min is always compared to the amount of compensation, and Consumer Rates Index alterations (CPIs). Because the CPIs are applied to payment, settlement to own handicap constantly is higher than the new Minute pursuing the first 12 months. Whenever augmented compensation is claimed considering a father, the newest Le have to read the if or not and see the mother or father try completely based mostly on and you may supported by the new claimant. As the permanency of your condition is established, the fresh Ce doesn’t need to seek more info from you to definitely condition; although not, if there is a modification of one status, the newest claimant is needed to immediately report that switch to the newest OWCP.

A discussion: Should the All of us improve the $250,100 ceiling to your put insurance?

- As well, depositors should become aware of that one type of accounts try labeled relaxed revocable trusts because of the FDIC and experienced trusts whenever applying the limitation.

- “We make sure that you will find enough banking companies to fulfill all of our hope for you, that is to offer a specific FDIC insurance policies restriction. Unlike you starting an account from the ten urban centers, we basically take care of it for you.”

- An identical things affect the fresh Spouse’s unmarried membership places.

- Active December 20, 2006, the new FECA are revised from the Term IX of the Postal Provider Accountability and you will Improvement Act to establish a three-date waiting period ahead of Policeman may be offered to group from the united states Postal Service.

- (3) The evidence is always to introduce the claimant attended an examination or way to the brand new recognized functions burns off on the day(s) claimed to ensure settlement as payable.

- In accordance with the foregoing, your request a lump-sum fee are not felt and that is hereby declined.

Once findings try resigned with one scientific research recorded from the claimant, the fresh handicap research carrying the extra weight of the scientific evidence is to end up being published to the fresh Section Scientific Advisor (DMA) to have opinion. Note that DMA review isn’t required should your statement holding the weight of one’s medical research are out of an excellent referee doctor. Come across part 6(g) for the chapter. Provided an opening day as well as the part of losses (what number of days of entitlement), the newest payment system often instantly calculate the brand new finish date away from an enthusiastic honor and you will cancel costs accordingly at the conclusion of that period. That point of your own prize usually has a portion of a great day expressed as the a quantitative, and this is paid after the newest prize period.

Just what it methods to have FDIC insurance rates

This is simply not getting confused with “risk spend” awarded to have dangerous characteristics with time away from conflict, which is omitted since the discussed in the next part. (g) “Non-watch” or Non-watch-position new-casino.games his comment is here spend. This can be paid off to ready seamen otherwise motor staff that are performing protection requirements for a specific boat. These are the merely 2 kinds of personnel which can get earn it spend included in the assigned obligations. (11) Wages taken care of Federal Protect provider when registration on the Federal Protect are a condition of your employee’s civil employment to the Shield.

(1) For each diem gotten by an employee during a travel position. (16) “Snowy extra” shell out received by the team functioning in the Overseas Arctic Weather Stations away from the fresh Federal Oceanic and Atmospheric Government, Agency out of Trade. That is paid back whenever a certain task demands a crew affiliate to overlook foods or sleep (for example a role that is expected at night). (6) The brand new Le is to prepare a memorandum setting forward that it devotion and you will explaining the basis because of it.

Essentially, the brand new EA makes write-offs from last go out in which the new claimant acquired shell out. In this case, OWCP write-offs to possess HBI and you will LI end up being productive the next diary day. If the various other day during the last deductions is really present (elizabeth.grams. the end of the new shell out period), the fresh Ce is always to play with one to date and commence write-offs your day just after. (2) Whenever an alternative Max is made, it’s compared to quantity of payment within the per instance at the Maximum. If your payment is more than the existing Maximum however, shorter compared to the the new, settlement can be repaid from the regular rates. Adjustments are built retroactive on the productive go out of your the brand new Maximum, that’s usually the go out away from a boost in the new Government spend level.

Life Property Beneficiaries

Sure, on the internet financial institutions are typically FDIC insured. Discover the brand new FDIC insurance policies signal to your a bank’s website otherwise browse the FDIC’s BankFind tool. This may influence and therefore items we comment and write on (and where the individuals items appear on your website), nevertheless never has an effect on the guidance or information, which are rooted in the hundreds or even thousands of hours away from lookup.

Tips Know if Your bank account is covered

This can be sure a high proportion away from covered depositors is actually secure under the system, it said. “Considering the put gains also to improve the visibility to possess short depositors, i agree with MAS’ proposal to boost the new publicity limit to $one hundred,100000,” GXS Financial said. Ever since then, the fresh portion of totally covered depositors has fallen in order to 89 for each and every cent while the earnings and places grew. SINGAPORE – Insurance coverage to the lender deposits might possibly be increased in order to $one hundred,000 for each and every depositor away from $75,000 currently, the fresh Monetary Power from Singapore (MAS) told you to the Tuesday. As a result of a system, the burden out of “splitting” large dumps is on the financial institution rather than the fresh depositor and can also be for this reason become more glamorous specifically for individuals with deposits you to would need an unwieldy number of membership to fully insure.

Severance spend is short for a certain number of weeks value of income otherwise wages, and it is constantly computed because the a lump sum. Health and fitness benefits and you can optional life insurance policy can get keep in the chronilogical age of severance shell out so long as the fresh OWCP at some point makes repayments to the period of time covered by the brand new severance shell out to help you work out of Staff Administration (OPM). The brand new claimant doesn’t discovered Policeman through to the 4th day’s impairment. If impairment extends past two weeks, the fresh Postal Solution can give the brand new claimant the decision to transform the 3 waiting months in order to Cop.

The new rule says that Manager has figured lump-contribution repayments will not be produced for professionals lower than sections 8105 and you will 8106. A recipient within the a death circumstances might be told your lump-share payment to help you a partner from a deceased employee will most likely not exceed 60 weeks from settlement. Any such lump-sum honor could end up being at the mercy of the newest proviso that unexpected fee out of survivor’s benefits was not the main supply of money on the beneficiary. (3) Pros will not necessarily end up being reinstated if the fresh worker signifies that the problem provides worsened, as the they has been in a position to remain carrying out the brand new changed work even if the reputation worsened. Therefore, where a formal LWEC decision wasn’t awarded, the fresh making use of their service might be expected add an explanation of the newest employee’s jobs commitments, for instance the physical standards, during breakup.